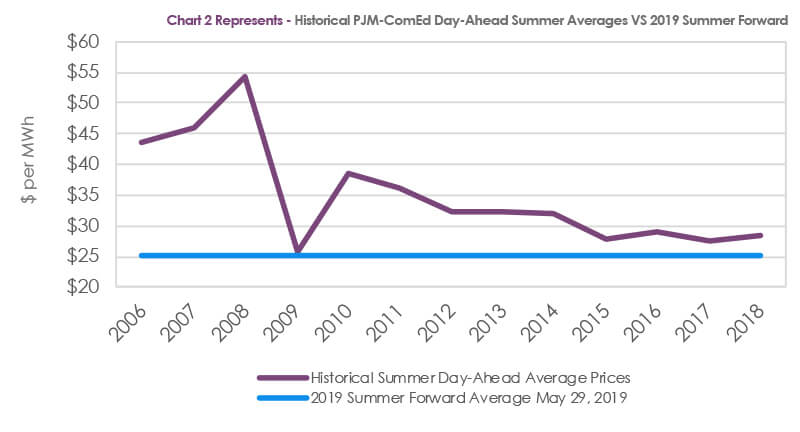

The prompt (2019) summer forward electricity market is at very low levels for the ComEd zone of PJM. For commercial customers who are accustomed to receiving day-ahead index pricing, this may be an opportune time to lock in fixed pricing for the remainder of the summer.

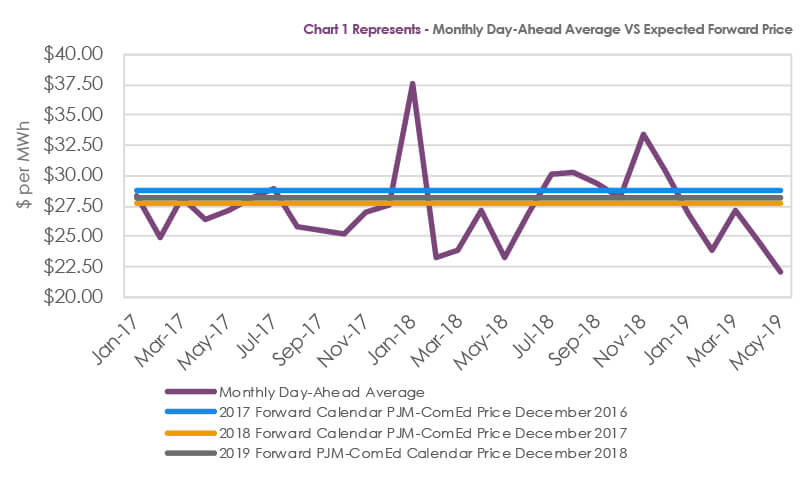

Summer is defined by PJM as June 1-September 30. While we are now in June, it is still possible for customers to lock in low prices for the July-September period. We have stated many times in this report that one of the central tenants of energy risk management for consumers is managing the upside price risk that has always been an element of electricity pricing. An additional component of electricity forward pricing is the concept of convergence combined with the theory that, over time, spot electricity will be cheaper than forward electricity prices because forward electricity prices have an event premium attached to them. These theories have seemed to work quite well up until recent history regardless of the absolute price level at any point in time. This theory has not been as easy to implement over the recent past as the electricity forward markets have been in backwardation, meaning the further out on the price curve one goes the cheaper prices are. This phenomenon has transpired for a myriad of reasons, cheap natural gas prices and subsidized renewable and nuclear generated electricity being two of the main drivers impacting forward prices. We have been proponents of fixing prices in this environment since the market has been pricing in discounts to spot of as much as 10%. A review of Chart 1 will show that until recently, this has been generally a decent strategy, eliminating upside risk in 2017 by paying 6.42% more than the clearing Day-ahead price and then locking in fixed prices for 2018 at prices 3.09% lower than the average clearing price. It has not worked as well in 2019 YTD as the projected forward price for calendar year 2019 in December 2018 was $28.13 per MWh, while the Day-average through May 2019 has been $25.09 per MWh, so the elimination of upside risk so far in 2019 has cost 10.8% (($25.09-$28.13)/$28.13). This does not mean that fixing prices for 2019 was a bad strategy since we have not finished the year and we do not yet know the final Day-ahead clearing pricing.

Forward prices for the balance of the year (June-December 2019) as of May 29th reflect expectations of continued low Day-ahead prices as the forward price for the last 7 months is $25.77 per MWh. This seems mispriced as there is absolutely no event risk being applied to the summer timeframe (see Chart 2).

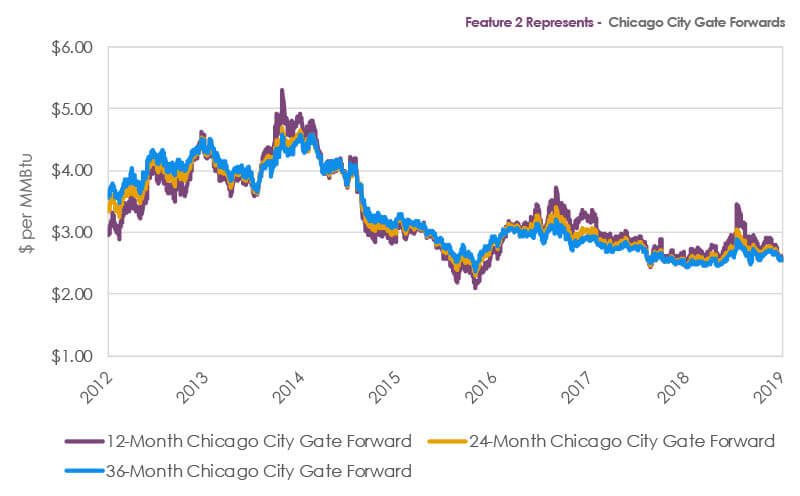

Electricity has also been quiet YTD in 2019. Day-ahead prices have been weak. The Day-ahead average price for the first four months of 2019 has been $25.93 per MWh, 7.72% lower than the average day-ahead price of $28.10 per MWh observed for the same period in 2018. Forward pricing has been mixed so far in 2019 with the 12, 24, and 36-month PJM/ComEd rolling forwards -2.16%, +.68%, and +.66% respectively to $27.22, $26.52, and $26.03 per MWh. While the price movements have been small, the curves have become less backwardated, though prices are still lower the further one goes out on the curve. One large change from April 2018 is that in April 2019 the cash prices are trading below forward prices as opposed to a year ago when cash prices were trading higher than forward prices. Everything being equal, it is better for the electricity consumers to be buying forward under the prevailing spot prices.

Returning to the theme of this article, we argue that any customers who are receiving index pricing for the summer should try and eliminate price rice risk by locking in the balance of the summer. While summer prices have been somewhat subdued the last four years, there is still substantial price risk that should not be ignored, and the market is providing an opportunity to transfer that risk to a supplier. Some of the reasons summer prices have been lower the last few years are (in no particular order): 1. Load growth has been low to non-existent the last few years as summer peak loads have not even approached their prior peaks (set in 2011) in either ComEd or the entire PJM system. 2. Generation assets have performed very well, especially many of the nuclear units. 3. Demand-side management has brought an awareness of usage during peak days. 4. Weather has been generally mild in that we really haven’t had situations where temperatures and humidity have stayed elevated for many days in a row, causing load build as people try and maintain comfort and operations.

We are not predicting that any of these items above are going to change. We are just making the point that the market is not pricing any chance of these things changing. Our argument is that if the market is not properly pricing risk, then customers should fix prices. In the case of the summer, we believe all four items are somewhat linked. An example would be that if we had a series of extreme weather days, generating assets could get stressed (causing outages), and load growth could jump as demand-side management becomes less effective as operating entities go about running their businesses. It is impossible to know the exact probability of this happening, but we do know that it is probably higher than what the current market is pricing into the summer forward curve for PJM/ComEd.

Analyst – David Mousseau

Source – PJM, CME, and Reuters