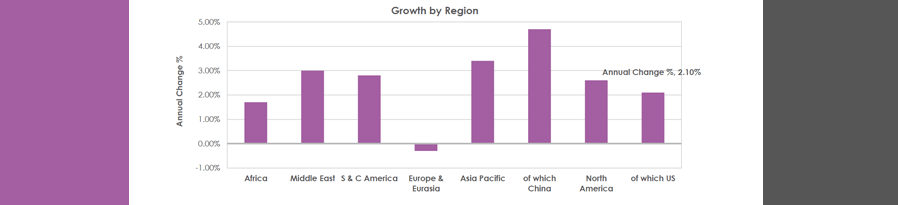

2013 saw an acceleration in the growth of global energy consumption, despite a stagnant global economy.

Energy production continued to be impacted by geopolitical events. Oil production in Libya suffered the world’s largest decline in the face of renewed civil unrest, and the production of oil and gas were disrupted in a number of other countries as well. In the face of these disruptions and heightened risks to supply, average oil prices exceeded $100 per barrel for a third consecutive year, despite massive supply growth in the U.S.

Oil

Oil prices averaged $108.66 per barrel in 2013, a decline of $3.01 per barrel from 2012. Overall, there was less than 5% volatility in the market. This can largely be attributed to growing US production as well as maintaining emergency oil stocks. The emergency reserves are set up to offset supply shocks and curb price surges, which have evidently worked in 2013. This is further entrenched by the market’s reaction to Iraqi tensions, where production and global supply of oil allowed the market to correct itself after an initial spike.

Global production outweighed all declines. South Sudan leads in terms of percentage of increase, as opposed to actual production. For actual production, the U.S is in the lead by adding over 52 million tonnes of oil production per annum over its 2012 production.

What we cannot ignore, is the growing gap of oil consumption which is higher than oil production over the last ten years. In 2003 the world consumed 2,577,150 barrels a day, more than it produced. In 2013 that number has grown to 4,522,696 barrels a day!

Gas

Global gas markets went through a rapid transformation in 2012, in 2013 they have somewhat plateaued. The two major developments were the US shale revolution and expansion of Liquid Natural Gas (LNG).

It can be argued that US shale is entering its saturated phase in the market, where the majority of fields have entered production. We are unlikely to see the unprecedented increases in production again to that of the 2005 gains.

Last year (2013), and already in 2014, has highlighted Europe’s vulnerability to low storage levels. Recent geopolitical events with Russia/Ukraine have also called for reforms to the European gas market. What these actual reforms will be remains to be seen. Overall, gas consumption in Europe decreased and continues to do so for the foreseeable future.

LNG shipments that were destined for Europe were diverted to South America as drought caused a drop in hydroelectricity production in the region. Asian demand is also decreasing as LNG prices are hurting economic growth, there is now a focus on pipelines rather than LNG in the region.

Decline in gas demand can also be attributed to an increase in coal fired power generation. As coal plants around the world are scheduled to shut down, operators are keen to run coal plants into the ground and maintain the longevity of gas fired plants by keeping them dormant till coal is forced to finish.

In Europe, gas and renewables make up the exact same percentage of power generation, 16% each.

Renewables

Despite high growth rates, renewable energy still represents only a small fraction of today’s global energy consumption. Renewable electricity generation (excluding hydro), is estimated to account for 5.3% of global electricity generation. Renewables are, however, starting to play a significant role in the growth of electricity, contributing 35% of the growth in global power generation in 2013.

The EU leads the world in renewable energy generation, closely followed by the US then China. However, we can expect this to change soon as the Chinese have now become the largest investors in renewable energy.