In the US, while the Midwest saw higher spot natural gas and electricity prices in response to the weather, it was quite muted compared to other regions in PJM or in the New York Independent System Operator (NYISO) and New England Independent System Operator (NE-ISO). It was interesting to note that these price spikes occurred even though all three of the Independent System Operators (ISOs) have adopted rule changes to try and prevent the scarcity pricing that occurred during the Polar Vortex Winter of 2014.

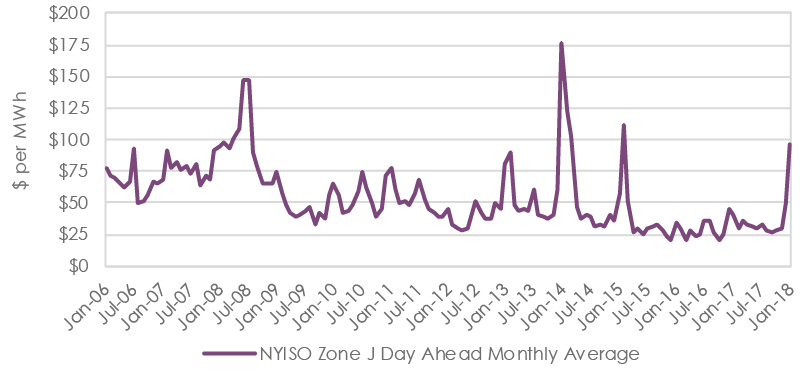

In New England, the average price for natural gas delivered at Algonquin was $14.75 per MMBtu, 41% lower than the $25.10 price seen in January 2014. Spot electricity delivered to the Mass Hub in the New England ISO averaged $108.47, 36% lower than the $169.08 per MWh price in January 2014. Zone J in the New York ISO was similar in that the average New York Transco Zone 6 natural gas price was $15.42 per MMBtu compared to the January 2014 price of $29.41 per MMBtu. Zone J spot electricity averaged $96.58 per MWh, 45% lower than the $175.92 per MWh price in January 2014.

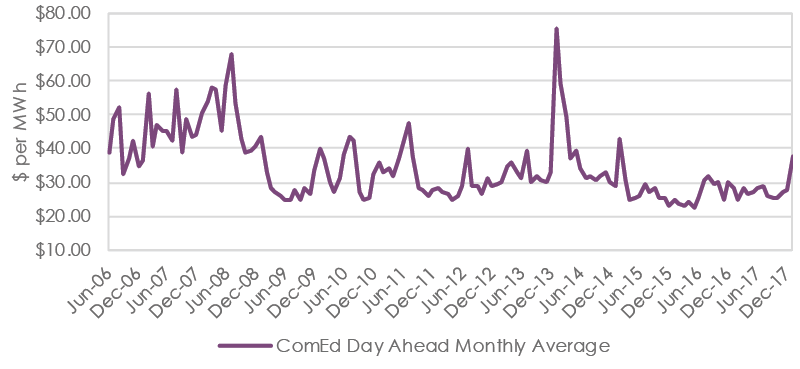

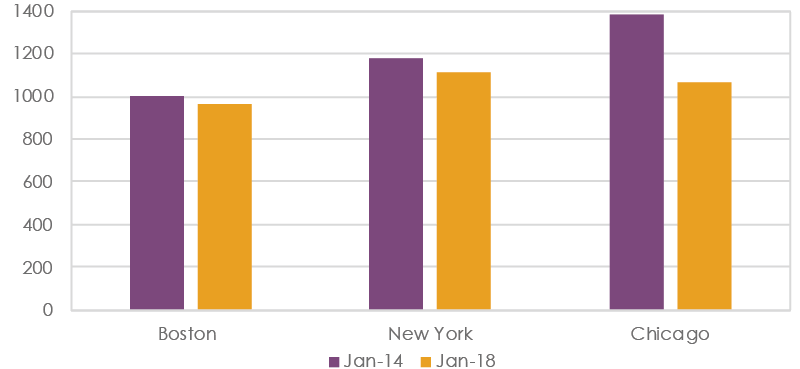

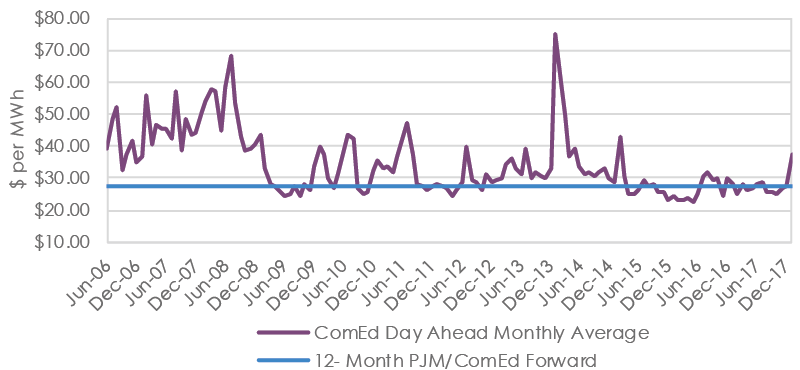

In the section above, we related that both Chicago City Gate and PJM/ComEd forward prices declined despite the higher spot prices. While the spot gas pricing of $3.96 per MMBtu and average power prices of $37.54 per MWh were higher, that is not scarcity pricing. The market seemed to indicate that if there is no scarcity pricing going forward, there is additional room for forward prices to decline. The one flaw in the argument is that, in the Midwest, Heating Degree Days (HDDs) were 22.73% lower in January 2018 than January 2014. HDDs measure the number of degrees that a day’s average temperature is below 65%, which is generally the temperature below which buildings need to be heated. The HDD’s were almost the same in January 2018 as January 2014 in Boston and New York City, which does explain the significantly higher spot prices in those areas. Additionally, these areas have traditionally experienced pipeline capacity issues in the winter, so the price spike is not unexpected. So, the fact that the aforementioned spot prices in these two regions were significantly lower than in January 2014 with basically the same weather, does show that the changes implemented by the ISOs did have some impact in reducing pricing spikes and increasing reliability.

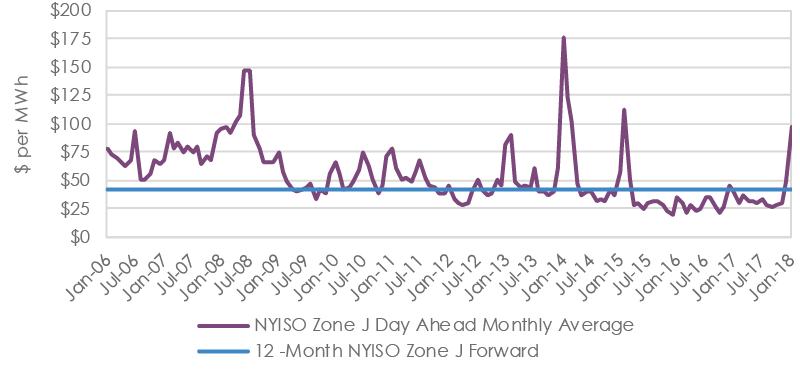

Regarding forward curves, they did increase in the New England Region, but Zone J was basically flat despite the higher spot prices, which makes sense because the forward curves in New England and New York always carry a large amount of risk premium due to the pipeline and transmission constraints, so an event of the magnitude we just experienced is usually priced into the winter portion of the forward curve. The 12-month Zone J Rolling Forward closed the month at $40.51. Any forward curve can be analyzed by looking at the individual monthly prices. The current 12-month forward starts with the March 2018 contract and goes through February 2019. If we assume the recent $96.58 January Day-ahead average price as an example of an outlier that may occur once a year, and then assume the 2017 average of $32.83 for the other 11 months, we can get a rough estimated theoretical price of $38.14 per MWh ((11*$32.83)+(1*$96.58))/12) . With the current price of $40.51, there is $2.30 of risk premium built into the forward in addition to the assumed outlier monthly price of $96.58. If there is not an outlier price event in the next 12 months, then it is quite possible the 12-month New York Zone J forward is overvalued.

The opposite situation exists in PJM/ComEd. The current 12-month forward, with the same starting March 2018 contract and going through February 2019, is $26.81 per MWh. If we assume the recent January PJM/ComEd monthly price of $37.54 as an outlier (it really wasn’t, as explained above) and assume the 2017 Day-ahead average of $26.95 for 11 months, we get a rough estimated theoretical of price of $27.83 per MWh ((11*$26.95)+(1*$37.54))/12). We can observe that the forward price is trading at about $1.00 per MWh below the rough theoretical price. This is occurring using a very weak outlier assumption. If we use a stronger outlier price of $75.38 per MWh (monthly average price in PJM/ComEd during January 2014), the current forward is undervalued by about 15.59%, ($ 30.99 per MWh ((11*$26.95)+(1*$75.54))/12)-$26.81)/$26.81).

There are many ways to interpret forward curves, and this is just one method. This method concludes that the 12-month NY-ISO Zone J forward curve is a bit overvalued and the current 12-month PJM/ComEd forward curve moderately undervalued.