Since the Polar Vortex of 2014, electricity markets have been characterized by generally falling prices and low volatility with a few winter (Feb 2015 and January 2018) weather-driven price spikes being the exception not the rule. The duration and extension of the decline has been driven by cheap fuel (shale natural gas) and by the growth of subsidized, no fuel cost renewable electricity generation. It has changed the dynamics of generators’ bidding strategies and caused many coal plants to retire. It also created a condition where now many unprofitable nuclear electricity generators need subsidies (generally paid on the distribution part of a customer’s bill) to remain operational for reliability reasons. The subsidy allows those plants to keep running at lower prices, depressing wholesale spot prices and forward curves. In no geographic location has this been more evident than in Illinois. PJM/ComEd forward curves recently have been indicating increasing lower prices the further out one goes on the price curve. This type of price action has the possible impact of making market participants complacent regarding the possibilities of electricity price increases in the future. To guard against such complacency, we would like to highlight two recent examples in other Regional Transmission Organizations (RTOs) where market forces and regulatory changes have caused rapid price increases in electricity forward curves.

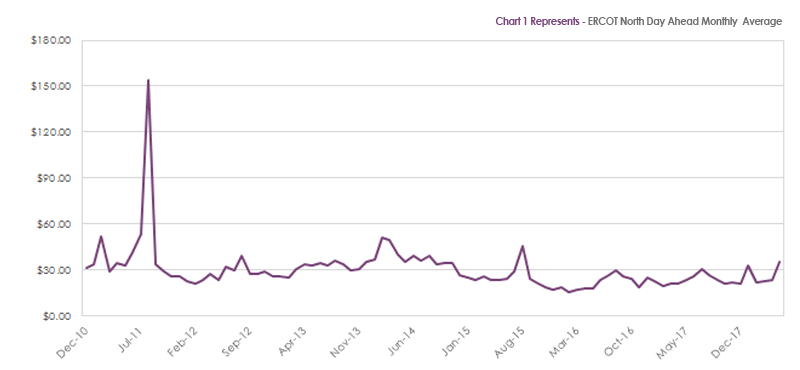

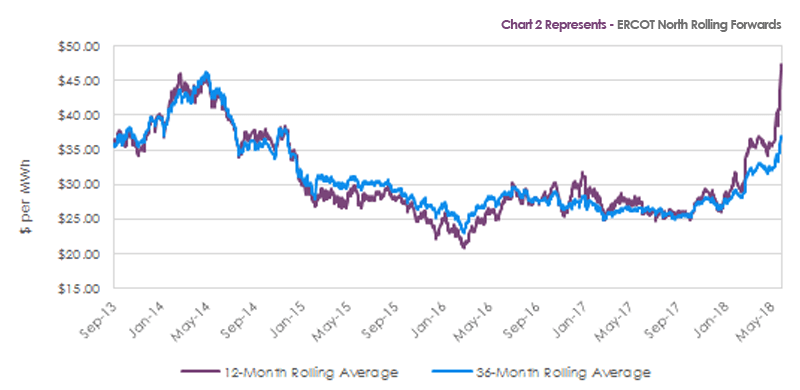

The Electricity Reliability Council of Texas (ERCOT) operates the electric grid and manages the deregulated market for 75% of the state of Texas. Over the last few years, Texas has also been a beneficiary of both low natural gas prices and subsidized renewable (primarily wind) electricity generation. Until recently, this was reflected by low electricity prices (see Chart 1). From 2015 through 2017, the average day-ahead price for electricity was $23.45. These low spot prices were reflected in the forward curves as shown in Chart 2 until December 2017. The event that has caused a price spike is somewhat unique to Texas but could occur anywhere in the country.

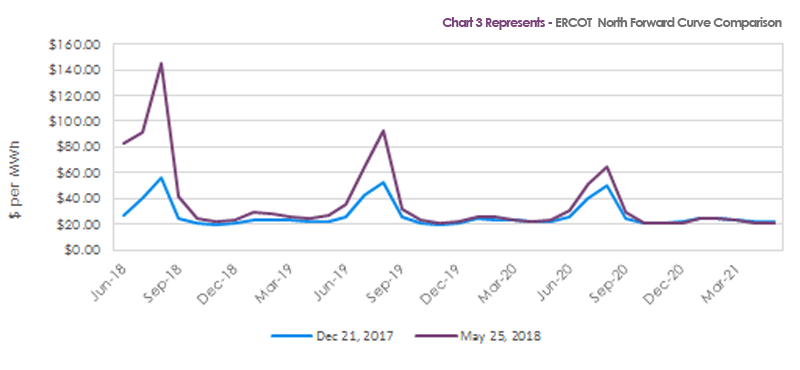

Like all RTOs, ERCOT has targeted Reserve Margins above projected peak consumption to ensure reliability. In May of 2017, ERCOT projected a summer 2018 reserve margin of 18.9% but changed that projection in December 2017 to 9.3% because of the unexpected retirement of many unprofitable coal electricity generating units. ERCOT does not have a capacity market, and it has an hourly price cap of $9,000.00 per MWh. This fact has led to increases in summer prices along the entire forward curve as the possibility of $9,000.00 hourly prices on a hot summer day has been priced into summer prices not only for 2018 but for 2019 and 2020 also. On December 21, 2017, the 12-month forward strip for ERCOT North was $26.13 per MWh, and on May 25th the price was $47.53, an increase of 81% for all hours in a calendar year. More dramatic was the 211% increase in the June 2018 forward from $26.53 per MWh on December 21, 2017 to $82.61 per MWh on May 25, 2018 and the 161% increase in the August 2018 forward from $55.77 per MWh to $145.44 per MWh for the same timeframe (see Chart 3).

This illustrates the example of scarcity risk due to a lack of generation resources. Scarcity risk poses the highest upside price risk. While it is not expected to occur in other areas this summer, it is worth pointing out that it was not expected in ERCOT either. An electricity consumer who has not fixed their energy obligations in ERCOT now must take an index price (which could be even higher than the quoted prices) or lock in at these extremely high levels. While hindsight is twenty-twenty, a solid price risk management program probably would have locked at least 50-75% of the exposures at the low levels observed in late 2017.

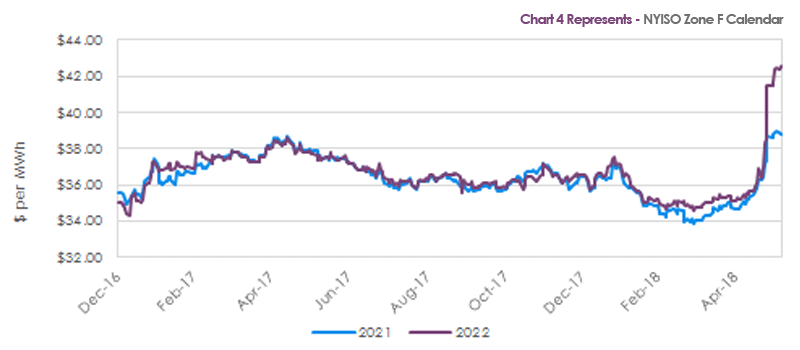

In the New York Independent System Operater (NYISO), we are currently experiencing an example of regulatory risk. Regulatory risk can be either downside or upside price risk depending on the regulation. During May, the NYISO started to really move ahead with a plan to incorporate a carbon tax/price into the price of wholesale electricity that is now determined by matching bids and offers and determining the lowest price after accounting for transmission congestion. The final details have yet to emerge, but NYISO is talking about filing a possible program with the Federal Energy Regulatory Commission sometime in the first half of 2019. Something of this magnitude would certainly take some time to implement. This is reflected in Chart 4, which shows the calendar prices for NYISO Zone F for calendar years 2021 and 2022. The largest increase in prices occurs in 2022 where the calendar price rose 20.83% from $35.09 per MWh on April 30, 2018 to $42.40 per MWh on May 31, 2018. Most of this price move occurred in the last half of the month. Whether this move will continue is questionable and will be determined by the path of the regulatory rulings. This event does explain that regulations and/or expected regulations can cause real sudden moves to wholesale energy prices.

Sources: CME Group, NYISO, ERCOT and Bloomberg