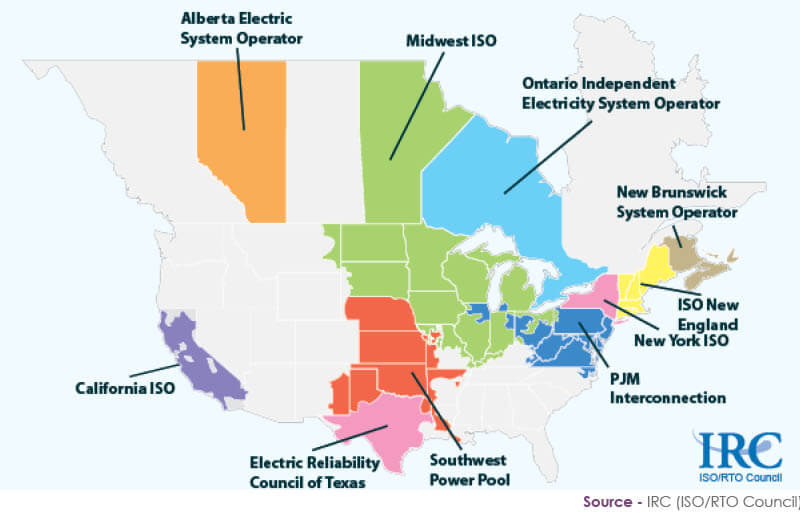

As we have discussed often in these pages, the states that have provided electric choice or deregulation have been in locations where there are competitive wholesale electricity markets, otherwise known as Regional Transmission Organizations (RTOs).

An RTO is an electric power transmission system operator that coordinates, controls, and monitors a multi-state grid. These RTOs are regulated by the Federal Energy Regulatory Commission (FERC). ComEd and Ameren operate in PJM and the Midwest System Operator (MISO) areas respectively. We also have customers who are in the NYISO, New England ISO, ERCOT, and Ontario Independent Electricity System Operator (IESO) (see RTO map ).

– The most important function that these RTOs provide is electricity grid reliability. They also serve as a price discovery mechanism to the particular areas the RTO is serving and the changing prices for different time frames (12, 24, and 36-month) that customers receive from suppliers are a function of the forward curves for the particular zones in a specific RTO. For example, the forward prices in PJM/ComEd are different than the forward prices in PJM/Dayton. They are also much different than the prices one would receive in NYISO Zone J (New York City). Each zone reflects the generating economics in their own area. We refer to these forward curves in every report because the curves do provide visibility to future pricing.

Also impacting the final amount a customer pays are regulatory schemes that are specific to each RTO and sometimes each utility. For example, as discussed in an article on page 3, ComEd charges each customer $.0019 (currently) per kWh as a subsidy for the state’s nuclear electricity generators because the state desires to have a reliable source of carbon-free electricity, and the current spot prices and forward curves do not support the economics of the nuclear electricity generating facilities on their own. This is not something that can be avoided, but it is good for a customer to know why it is there and why they are paying for it. This brings us to the specific reason for this article and the risks customers have from RTOs in deregulated areas of which they are not always aware.

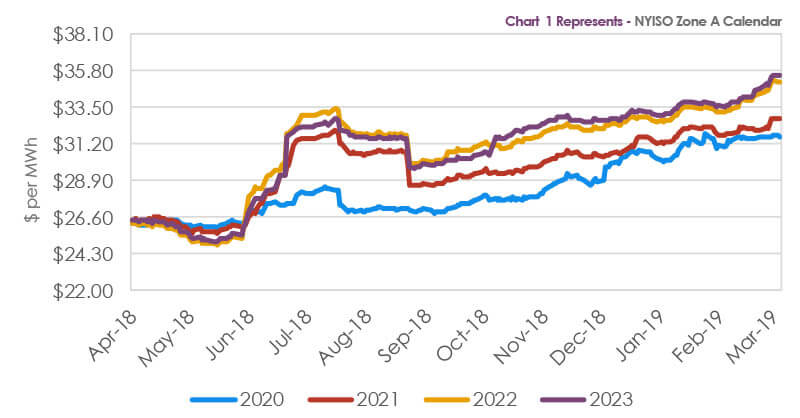

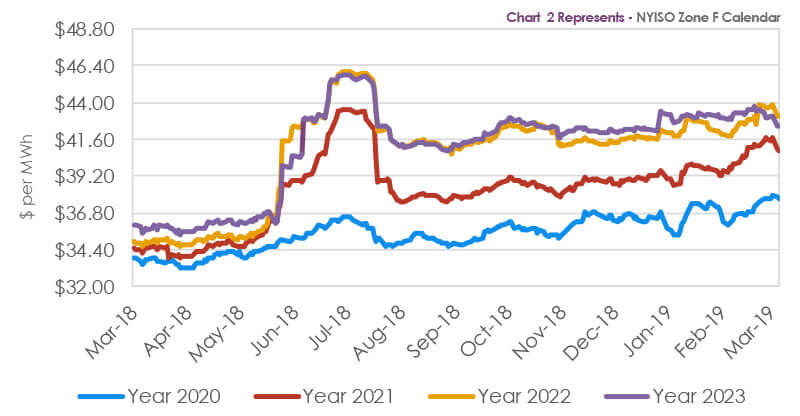

During the first part of calendar year 2018, the NYISO started to outline a potential design to incorporate the social cost of carbon dioxide emissions into their wholesale electricity markets. On April 30, 2018, the NYISO released a straw proposal, and on August 2, 2018, the NYISO published their Carbon Pricing Draft Recommendations. These recommendations aim to propose market design concepts to incorporate the social cost of carbon in a way that is 1) economically efficient and avoids major cost shifts among all New York customers. 2) it is transparent and 3) it provides market and regulatory stability. There are some moving parts to this, and it is expected to be filed at FERC in January of 2020 with an implementation during the 1st quarter of 2021. As risk managers, the one thing that has really caught our attention is how immediately and decisively the forward curves in the New York ISO priced this into the 2021 and 2022 forward curves.

A review of charts 1 and 2 show how these proposals have impacted the forward curves for electricity in Zone A and Zone F. The calendar prices in Zone A have increased 20.77%, 24.98%, 33.92%, and 35.94% for the 2020, 2021, 2022, and 2023 calendars strips, respectively, since April 2, 2018. It has been slightly more muted in Zone F with the calendar prices up 13.64%, 22.23%, 25.93%, and 21.19% for the 2020, 2021, 2022, and 2023 calendar strips, respectively, since April 2, 2018. While we do not know the final form the proposal will take, we do know the customer who locked in for four years out to 2022 when the price curves were both low in price and relatively flat is in better shape than if they had not done so.

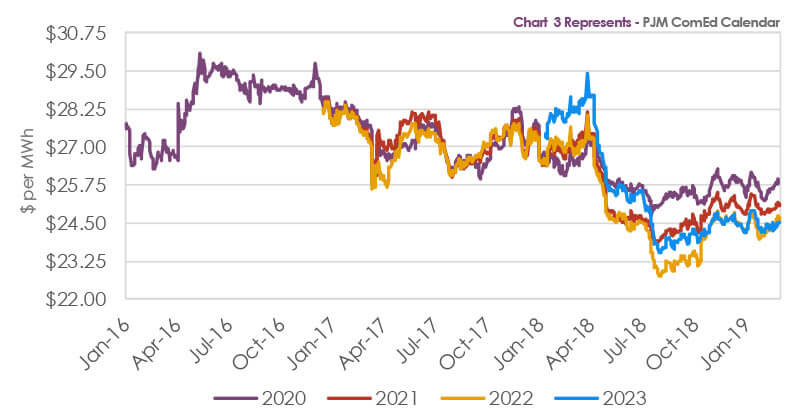

This is an important point for energy consumers in PJM because currently PJM is having many debates about their own capacity and energy markets. The annual three-year forward PJM capacity auction has been postponed from May 2019 to August 2019 as PJM has had its capacity auction proposal sent back to it by FERC. The main difficulty PJM is facing in their capacity auction is how to accommodate facilities (renewable and nuclear) who receive subsidies when they are participating in the capacity market as to not disadvantage other generators who do not have similar subsidies. In March 2019, PJM is also expected to file an Energy Price Formation proposal with FERC. In basic terms, the main goal is to lift the clearing price for all generators as opposed to paying some generators out of merit prices while paying the rest of the generators a lower clearing price.

A review of the PJM/ComEd market (chart 3) shows the current calendar prices for 2020-2023 very near the historical lows. While prices can always go lower, the risk-reward play is to lock in prices for as long as possible to combat the possible upside risk due to regulatory changes.

Analyst – David Mousseau

Source – NYISO, PJM, ENGIE, and RTO Insider